The Elliott Wave Principle

Contents:

It is always better to buy books in order to support the authors and publishers. As the hard-working writer diligence should be paid off. Thus, a movement to a new extreme in an established trend by one average alone is a new high or new low which is said to lack “confirmation” by the other average.

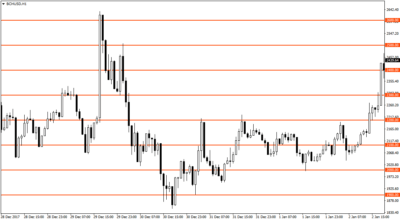

On the chart below you can see all characteristics of the regular flat. Pay attention to the depth of wave B compared to wave A. These track-records represent a sampling of some of the price forecasts we have published in our various publications of the last two decades since WaveTrack’s early beginnings in 1992. We consider ourselves EW ‘purists’ in the manner of R.N.Elliott’s original works and from the later expanded interpretations of A. Our own history of EW begins from the late ’80’s that has over the years placed more and more focus on geometric ‘Ratio & Proportion’, measurements that help define each and every EW pattern.

Just like all other forex trading strategies, the accuracy of the Elliott wave approach is determined by the trader. Our first take profit level would be on the next support level BELOW the starting point of wave 2. This is because as per the rules, the end of wave 3 should extend further from the end of wave 1. After rising for a short distance, the price obeyed our first rule as wave 2 did not retrace into the territory of wave 1. After the lower high formed, the price went lower and reached a minor support level where it began going up. Wave 2 formed perfectly as well since it did not rise beyond the start of wave 1.

How Can I Apply the Elliott Wave Principle

So, each completed ABC-sequence in the ain direction of the formation is called W, Y or Z, with the in-between waves called X . X-waves can be large or small, and very often they have no discernable internal structure and are similar to a shaky line. Larger X-waves can and often do develop an ABC-structure, and they are counted as corrective waves. 12 shows the most common way alternation occurs, that is, wave 2 is a simple ABC-formation, often much less in time than fig. 12 indicates, followed by some sort of more drawn out and complex correction in wave 4. 12 I’ve drawn a small triangle, but it could also be a Flat-formation, or a complex correction.

It stays the same, regardless of whether we are looking at a yearly or a five-minute chart. The Elliott Wave theory was developed by Ralph Nelson Elliott in the 1930s. In an expanding triangle, subwaves B, C, and D usually retrace 105 to 125 percent of the preceding subwave. In an expanding triangle, subwaves B, C, and D each retrace at least 100 percent but no more than 150 percent of the previous subwave. In a flat, wave B usually retraces between 100 and 138 percent of wave A.

Download Elliott Waves Made Simple Book in PDF, Epub and Kindle

An initial 5-wave move against the larger trend is never the end of the correction, only a part of it. The message truncations send is that there is tremendous pressure to start the new trend. Motive sequence is much like the Fibonacci number sequence.

But according to https://forexhistory.info/, financial markets create patterns of afractal nature. So, if we zoom out to longer timeframes, the movement from 1 to 5 can also be considered a single Motive Wave , while the A-B-C move may represent a single Corrective Wave . Initially, the EWT was called the Wave Principle, which is a description of human behavior. Elliott’s creation was based on his extensive study of market data, with a focus on stock markets. His systematic research included at least 75 years’ worth of information. Waves A and C are made up of five waves characterized by (), (), (), (), and ().

Those basics are fully described in the standard textbook of wave analysis, Elliott Wave Principle — Key to Market Behavior, by A.J. Remember — applying the Elliott Wave Principle is simple, but mastering that application takes years of practice and hard work. Corrective wave patterns unfold in forms known as zigzags, flats, or triangles.

- 2nd and 4th corrective wave – and the alternation guideline.

- Elliott was of the opinion that these patterns most often occured at the the end of a 3rd wave or at the end of a strong correction.

- By adhering to the rules, we can easily identify the perfect waves and use them in making our trading decisions.

- The diagram below clearly illustrates the movements of Elliott waves.

- This process continues into Primary, Intermediate, Minute, Minuette, and Sub-minuette waves.

He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in this book “The Wave Principle”. In Elliott’s theory, market prices alternate between an impulsive, or motive, phase, and a corrective phase on all time scales of trend, as the illustration shows. Corrective waves subdivide into three smaller-degree waves starting with a five-wave counter-trend impulse, a retrace, and another impulse. In a bear market the dominant trend is downward, and the pattern is reversed—five waves down and three up.

In other words, if you want to count the sub-waves of a correction, you could start your count from the end of the previous wave. These impulse and corrective waves are nested in a self-similar fractal to create larger patterns. For example, a one-year chart may be in the midst of a corrective wave, but a 30-day chart may show a developing impulse wave. A trader with this Elliott wave interpretation may thus have a long-term bearish outlook with a short-term bullish outlook. The EW-Forecast software that displays each chart has been especially created to illustrate the entire time-series of each contract (e.g. S&P 500) in the correct hierarchical sequence.

Using https://day-trading.info/ ratios simplifies the process of counting and labelling waves correctly. These guidelines will help to determine whether a market is trending or correcting and will help forecast where each individual wave might find support or resistance. As “Logging Reversals,” below, shows on a S&P 500 weekly chart, closing prices correspond to the numbers running along the Square’s cardinal and diagonal lines. They seem to appear in clusters, each possibly characterizing a different cyclic wave, yet the absence of input from coordinate-X shows no orderly swing distribution. The following Elliott wave patterns are listed alphabetically, followed by a glossary of terms used on these pages.

During the early 1940s, the Wave Theory continued to develop. Elliott tied the patterns of collective human behavior to the Fibonacci, or “golden” ratio, a mathematical phenomenon known for millennia as one of nature’s ubiquitous laws of form and progress. After a long career in various accounting and business practices, R.N. Elliott was forced into an unwanted retirement at the age of 58 due to an illness contracted while living in Central America. Needing something to occupy his mind while recuperating, he turned his full attention to studying the behavior of the stock market. Waves 1, 2, 3, 4 and 5 form an impulse, and waves A, B and C form a correction.

Simple corrections.

As such, in a downtrend, wave 4 should end below wave 1’s end. Again, in an uptrend, wave 4 should end above the high of wave 1. The end of wave 2 should not be equal or larger than the starting point of wave 1. Similarly, after the first phase ends, a reversal uptrend forms.

- Wave 2 can’t retrace more than 100% of the preceding wave 1 move.

- Interestingly, there is a growing number of traders combining the Elliott Wave Theory with technical indicators to increase their success rate and reduce risks.

- He then began to look at how these repeating patterns could be used as predictive indicators of future market moves.

- When investors first discover the Elliott Wave Principle, they’re often most impressed by its ability to predict where a market will head next.

Elliott’s highly specific rules keep the number of valid interpretations (or “alternate counts”) to a minimum. The analyst usually considers as “preferred” the one that satisfies the largest number of guidelines. The top “alternate” is the one that satisfies the next largest number of guidelines, and so on. The Elliott Wave Principle also gives you a method for identifying at what points a market is most likely to turn. Elliott Wave practitioners stress that simply because the market is a fractal does not make the market easily predictable. Scientists recognize a tree as a fractal, but that doesn’t mean anyone can predict the path of each of its branches.

If wave II retraces more than 100% of wave I, that whole wave becomes invalid and the counting should start again. Interestingly, old as it is, the method has proven to be a tough concept for most traders. This is no surprise, since the method is a pretty tricky trading concept, even for the big boys, at times. Wave interpretation rules and Fibonacci relationships together are powerful tools for establishing investment strategies and reducing risk exposure. Applying the Elliott Wave Principle aids investors in deciding where to get in, where to get out and at what point to give up on a strategy. Thus, the Elliott Wave Principle lets you identify the highest probability direction for the market.

In the art of market chart analysis, one of the most popular and interesting approaches is the Elliott Wave Theory principle. This Wall Street bestseller is the most useful and comprehensive guide to understanding and applying the Wave Principle. A groundbreaking investment classic, Elliott Wave Principle is hailed by reviewers as the “definitive textbook on the Wave Principle.” Technical analysis hinges on the belief that psychology influences trading in a way that enables predicting when a stock will rise or fall.

Since theElliott Wave theoryis a law of nature, they are still applicable today with the same success rate. If you have been following everything till now, you have probably noticed the Wave Principle’s ability to forecast reversals. While the majority of traders and investors simply rely on the trend, Elliotticians have an edge of being able to prepare for a probable change in the trend’s direction. We do not say that the method is easy to learn and apply, but if you work and study hard, we promise it will become your favorite. The Elliott Wave theory is a form of technical analysis that looks for recurrent long-term price patterns related to persistent changes in investor sentiment and psychology.

After years of research, The Elliott Oscillator was developed. Among waves 1, 3, and 5, wave 3 can’t be the shortest, and is often the longest one. The Structured Query Language comprises several different data types that allow it to store different types of information… Knowing these guidelines can help you decide where a market is within each particular phase. In this article, we will explore the basics of the Elliott Wave Principle and how it can be used to analyse the markets.

A correction often just keeps on going, too, whereupon it isn’t a correction but a true reversal and thus a new trend in the opposite direction. \n\nElliot Wave practitioners are the first to admit that calling corrective waves is tricky, much harder than seeing impulse waves. Elliott described specific rules governing how to identify, predict, and capitalize on these wave patterns. Elliott Wave International is the largest independent financial analysis and market forecasting firm in the world whose market analysis and forecasting are based on Elliott’s model.

Download ELLIOTT WAVE PRINCIPLE KEY T Book in PDF, Epub and Kindle

Numbers from the https://forexanalytics.info/ sequence surface repeatedly in Elliott wave structures, including motive waves , a single full cycle , and the completed motive and corrective patterns. Elliott developed his market model before he realized that it reflects the Fibonacci sequence. “When I discovered The Wave Principle action of market trends, I had never heard of either the Fibonacci Series or the Pythagorean Diagram”. Each degree of a pattern in a financial market has a name. Practitioners use symbols for each wave to indicate both function and degree.

Elliott Wave Update of SP500 – February 8th, 2023 – EWM Interactive

Elliott Wave Update of SP500 – February 8th, 2023.

Posted: Wed, 08 Feb 2023 08:00:00 GMT [source]

Elliott wave analysis requires patience and diligence, but it is very simple to employ. “Alternate counts” are simply side roads that sometimes end up being the best path. The Elliott Wave Principle is a detailed description of how groups of people behave. It reveals that mass psychology swings from pessimism to optimism and back in a natural sequence, creating specific and measurable patterns. As a result of Elliott’s pioneering research, today, thousands of institutional portfolio managers, traders and private investors use the Wave Theory in their investment decision-making.